Agenda > Nature-based Solutions Investment Summit

6 de Junho

Liderado pela Capital for Climate (exclusivo para investidores). Um dia cuidadosamente selecionado, com mais de 30 oportunidades em Soluções Baseadas na Natureza (NbS), casos reais de captação de recursos e iniciativas rumo à COP30.

Credenciamento e Welcome Coffee

Boas-vindas e Abertura

Programação do Dia: Sinalizando a Inserção das Soluções Baseadas na Natureza no Mainstream

James Allen, Executive Director, Olab – MC

Tony Lent, Host, Co-founder, Capital for Climate

Impulsionadores de Políticas para a Bioeconomia e Soluções Baseadas na Natureza rumo à COP30

Rafael Dubeux – Secretary Ecological Transformation Plan, Ministry of Finance

André Aquino – Head of Economic and Environment Office, Ministry of Environment & Climate Change (MMA)

Palestra Principal – COP30 – Expectativas, Objetivos e a Liderança do Brasil

Dan Ioschpe, COP-30 High Level Champion

Mercado de Carbono no Brasil e Acordos de Compra de Carbono, Investimento na Cadeia de Valor da Agricultura Regenerativa e Commodities de Fluxo de Caixa Descontado (DCF).

Julia Osterman Strong, Executive Director, Symbiosis Coalition

Izabel Ramos, Nature-based Solutions Senior Manager, Petrobras – Pro Floresta+

Claudia Bassetto, Head of Procurement Nutrition LATAM, Unilever Alimentos

Pamela Moreira, Head of Sustainability in South America, Bunge

Coffee break

Ambiente Favorável e Inovação em Financiamento em Larga Escala.

Mario Gouveia, EcoInvest Lead, National Treasury

Nabil Kadri, Deputy Managing Director of Environment, BNDES

Rodrigo Lauria, Director, Climate Change & Carbon, Vale

Daniel Porto, Head of DCM Brazil, HSBC

Danielle Carreira, Head of Finance Sector Engagement, Tropical Forest Alliance at WEF

Por que Investidores Internacionais [NbS] Estão Vindo para o Brasil

Van Butsic, Director of Project Design, Carbon Direct

Raphael Falcioni, Managing Director, Just Climate

Tobias Walzberg, M&A Manager, Radar-Nuveen

Renata Campos, Climate Asset Management, Investment Associate

Casos de Sucesso e Marcos na Formação de Capital

Peter Fernandez, CEO, Mombak

Jose Pugas, Founding Partner and Chief Sustainability Officer, Régia Capital

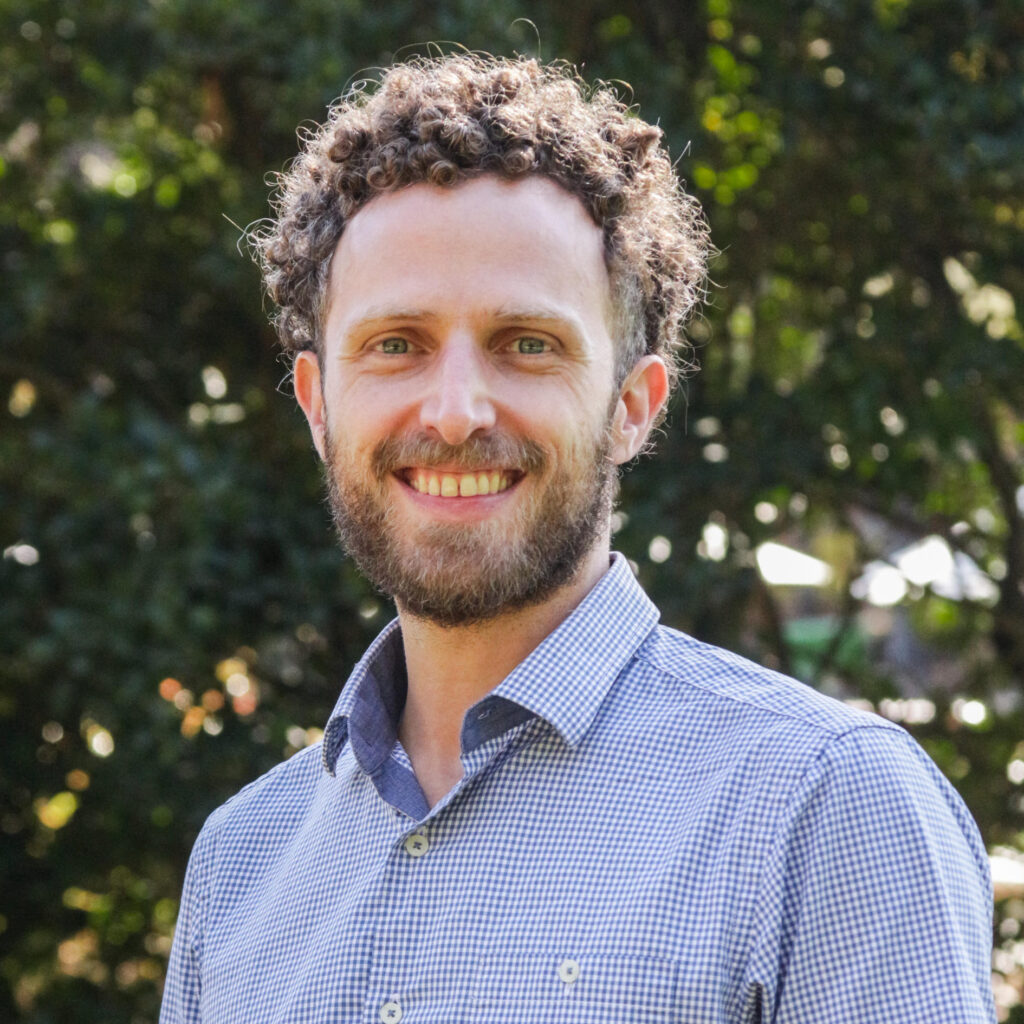

Pedro Faria, Co-CEO and Chief Investment Officer, Patria

Mario Lewandowski, Partner, AGBI

Apresentações de Oportunidades em NbS:

Sala A | Trilha 1

Plataformas de Desenvolvimento:

Sala B | Trilha 2

Empreendimentos Inovadores:

Sala C | Trilha 3,

Fundos e Veículos:

Apresentações de Oportunidades em Soluções Baseadas na Natureza (NbS):

Sala A | Trilha 1

Plataformas de Desenvolvimento:

Sala B | Trilha 2

Empreendimentos Inovadores:

Sala C | Trilha 3

Fundos e Veículos:

Recepção com Coquetel

Project Developers

Courageous Land implements large-scale reforestation and conservation projects through agroforestry, producing climate-positive food, hardwood, and carbon credits. Their AI platform helps identify ideal planting sites through system modeling and environmental analysis.

Philip Kauders

CEO and Co-Founder

Symbiosis specializes in reforestation and sustainable forest management in the Atlantic Forest biome. Operating through three core areas—seedling nursery, production forests, and R&D—the company produces native wood species, seedlings, and carbon credits.

Alan Batista

Chief Financial Officer

Biomas restores degraded areas through native tree planting in a vertically integrated operation—from restoration to carbon credit sales. The company operates across Brazil’s biomes, with a focus on the Amazon, Atlantic Forest, and Cerrado regions.

Fabio Sakamoto

Chief Executive Officer

re.green is a Brazilian ecological restoration company committed to restoring one million hectares of degraded land in the Amazon and Atlantic Forests. By integrating carbon credit generation, sustainable timber production, and community engagement, re.green aims to capture 15 million tons of CO₂ annually.

Thiago Picolo

CEO

Perfin Investimentos is an independent Brazilian asset manager specializing in equities and infrastructure. Founded in 2007, Perfin focuses on long-term partnerships and capital preservation. The company has also collaborated with Equipav to invest in Brazil’s highway sector, emphasizing sustainable development and technical expertise.

João Siqueira

Founding Partner

MORFO specializes in large-scale restoration of native forest ecosystems using forest engineering, computer vision, and drones. Operating in tropical and subtropical regions, MORFO provides end-to-end restoration solutions from diagnostics to monitoring.

Pascal Asselin

CEO and Co-Founder

Caaporã is a holding company producing carbon-neutral or low-carbon proteins by investing in ICLF systems, specializing in low-carbon meat and dairy products.

Luis Fernando Laranja

CEO and Founder

Luxor Agro specializes in implementing regenerative agriculture and restoring degraded farmland on large-scale farms through two main approaches: integrated crop-livestock systems and coffee production through agroforestry systems.

Daniel Baeta

Chief Executive Officer

New Ag is an investment platform specializing in sourcing, structuring, and managing agricultural landscapes to drive the transition to regenerative agriculture, focusing on large-scale farming projects that restore native vegetation.

Carl-Fredrik Wachtmeister

Head or Farming Operations

Samauma collaborates with local communities and strategic partners to implement conservation projects throughout the Amazon region, establishing a mutually beneficial framework that generates carbon credits while fostering sustainable community initiatives.

Nicolas Londono

Chief Executive Officer

Radix transforms degraded lands into a force for regeneration — creating green assets that connect forest, finance, and a thriving future for the Amazon.

Ana Júlia Ferreira

Project Management Officer

Belterra promotes agroforestry practices in degraded areas while supporting partner farmers’ transition to sustainable agriculture by providing technical assistance and facilitating credit and market connections.

Marcelo Pereti

Chief Financial Officer

Funds & Vehicles

AGBI is a specialist real assets manager that acquires and leases degraded pastureland, restoring it by converting it into farmland for high-value crops. The AGBI III Carbon fund focuses on transforming degraded pasture areas into cropland in the Cerrado biome, enabling carbon credit trading and land appreciation above inflation.

Mario Lewandowski

Dir. of Business Development

Patria is an alternative investment platform in Latin America. In 2024, it joined efforts with Pachama to launch the Reforest Fund I for greenfield ARR projects in Latin America. Managed by Patria, the fund aims to reforest degraded pasture lands, primarily in Brazil.

Beatriz Lutz

Climate and Forest Investments

Régia Capital is an asset manager created by JGP and Banco do Brasil Asset that manages sustainable investment funds for the Global South, focusing on NBS, renewable energy, sustainable infrastructure, and decarbonization.

Cláudio dos Anjos

Head de investimentos sustentáveis da Régia Capital

VOX CCAT is a Brazilian multi-strategy investment fund providing de-risking capital to financial vehicles offering credits to producers transitioning to sustainable practices, committed to zero deforestation in the Amazon and Cerrado biomes.

Daniel Brandão

Partner, Nature-based Solutions Director

Profuzindo Certo is a regenerative agriculture fintech platform that focuses on risk reduction, analysis, and providing credit for transformation.

Luís Lapo

Director of New Business

The Growth Next-Generation Agriculture (GAN) is a debt facility created by Traive and Folio. It uses AI to connect lenders with firms developing sustainable solutions like organic fertilizers. Its goal is to remove market barriers, boost regenerative agriculture, and speed up farmers’ shift to sustainable practices.

Mauricio Quintella

Partner & Chief Sustainability Officer

The Yield Lab is a global agrifood tech venture capital firm investing in early-stage companies advancing sustainable agriculture. With regional funds in North America, Latin America, Europe, and Asia-Pacific, The Yield Lab supports startups developing technologies that improve productivity, reduce environmental impact, and enhance food system resilience. In Latin America, its fund focuses on scalable agtech and climate solutions that drive regenerative agriculture and carbon-efficient value chains.

Kieran Gartlan

Managing Partner

MOV Investimentos provides catalytic capital aimed at commercial returns and systemic change. The FIP MOV 2 fund focuses on the Brazilian Amazon. It aims to support businesses that combine biome regeneration with economic development through bioeconomy and innovation.

Paulo Belotti

Founder and Executive Director

Boldt Capital is a private equity firm formed from the merger of Circularis Partners (US) and Ecoa Capital (Brazil), focusing on climate investments. Boldt supports companies leading the climate transition, aiming for scalable impact starting in Brazil with a global perspective. The firm combines growth equity expertise to back ventures in sectors like sustainable infrastructure and clean technology.

Roel Collier

Partner

IWÁ Gestora is a Brazilian asset manager specializing in equities, wealth management, and structured funds, with a strong emphasis on sustainability and technology. The firm aims to foster a low-carbon economy by promoting sustainable practices and investments in clean technologies that minimize environmental impact and enhance energy efficiency.

Helo Baldin

Founder

The Sustainable Investment Facility uses blended finance strategies to drive sustainable initiatives in the Brazilian Amazon. It facilitates capital access while providing technical support and knowledge sharing for bioeconomy, low-emissions agriculture, renewable energy, and other sustainable initiatives.

Julia Forlani

Strategic Partnership Specialist

KPTL is a leading Brazilian venture capital firm resulting from the merger of A5 Capital Partners and Inseed Investimentos. KPTL focuses on innovation-driven sectors, including the Amazon bioeconomy. In partnership with Fundo Vale, KPTL has launched a fund to invest in startups that positively impact forests and climate, supporting technologies that enhance carbon credit efficiency and large-scale forest restoration.

Danilo Zelinski

Head of Investment for Nature and Climate Innovation

Innovation

Silva Brasil Bio organizes Brazil’s supply chain for native seedlings, connecting certified nurseries to ecological restoration, carbon credits, and agroforestry projects. Their platform enables efficient, large-scale commercialization of native plants.

Daniel Jimenez

Founder and CEO

LandPrint is a NatureTech company based in Brazil, offering a digital Measurement, Reporting, and Verification (d-MRV) platform as a SaaS solution. It provides granular, science-based assessments of environmental assets, enabling stakeholders to make informed, nature-positive investments and support regenerative agriculture practices.

Daniele Cesano

Founder and CEO

BioWorld is a company specializing in the development and commercialization of biological agricultural inputs. Focused on sustainable farming, it offers solutions that enhance crop productivity while reducing environmental impact, supporting the transition to more eco-friendly agricultural practices.

Ithamar Prada

CEO

Bioflore is an MRV startup that leverages AI and remote sensing to track carbon stocks and biodiversity impacts in restoration projects via its FloreViewer platform. A finalist in the XPrize Rainforest competition, Bioflore has a portfolio of 40 projects across 7 countries.

Heitor Filpi

CEO and Co-Founder

A finalist in the XPrize Rainforest competition, Map of Life provides a biodiversity platform that models species distribution using high-resolution global data. It integrates field validation through eDNA, acoustics, and LiDAR, offering API integration for ESG and MRV systems.

Chrissy Durkin

Chief Revenue Officer

A finalist in the XPrize Rainforest competition, Providence provides real-time biodiversity monitoring using AI, eDNA, and satellite data to track species, forest health, and ecosystem changes for IPLC territory protection and restoration projects.

Emiliano Ramalho

Project Coordinator

GainForest is a Swiss non-profit “decentralised science” platform founded in 2017 that couples AI-analysis of satellite, drone and field data with blockchain smart contracts on Solana to verify forest conservation in real time and auto-release payments to Indigenous communities and smallholders when ecological milestones are achieved, cutting monitoring costs and delivering transparent, performance-based finance for tropical forest protection.

Gabriel Nunes

Science Lead

Global Forest Bond is a company that integrates ecosystem preservation with the global economy through financial instruments. It issues Forest Preservation Assets, backed by the conservation of native biomes, which can be incorporated into financial products like Agribusiness Receivables Certificates (CRA). These assets quantify environmental services such as climate regulation and biodiversity preservation, providing landowners with financial incentives to maintain natural forests.

Artur Ferreira

Founder

Agrosmart is an agtech company offering a digital farming platform that utilizes big data and analytics to enhance agricultural efficiency and sustainability. Serving over 100,000 farmers in Latin America, it provides real-time insights into soil and climate conditions, optimizing resource use and crop yields.

Mariana Vasconcelos

CEO

InPlanet uses Enhanced Rock Weathering (ERW) to remove CO2 by applying crushed basalt rock powder to tropical soils, primarily in Brazil. The process regenerates soils and generates certified carbon credits through partnerships with farmers.

Felix Harteneck

CEO

AgTrace is specialized in agricultural supply chain traceability. Its platform connects all stakeholders in the production chain, providing real-time, secure information from farm to table. This ensures transparency, quality control, and compliance across various agricultural sectors.

Andre Turkienicz Maltz

Co-founder and CEO

umgrauemeio is a climate tech using AI, sensors, satellite, and field data to monitor, prevent, and respond to wildfires. Its Pantera platform detects fires in under 3 minutes, protecting restoration areas and enabling sustainable reforestation projects.

Osmar Bambini

Co-Founder and Chief Innovability Officer

Launched by Impact Bank, the $25M Amazon Food & Forest Fund supports sustainable MSMEs in the Amazon’s bioeconomy, focusing on IPLCs. It provides growth capital and discounted invoices, backed by a TA Facility.

Gabriel Ribenboim

CEO and Co-Founder

info@brazilclimateinvestmentweek.com

© BCIW 2026. TODOS OS DIREITOS RESERVADOS.